What Writing Expenses Are Tax Deductible?

If you’re trying to earn money from your writing (whether that’s by freelancing or trying to sell your novel) you get the benefit of business-related tax breaks. But there are some conditions. Here’s what you need to know.

I’ve been writing for a couple of years now, both working on a novel and doing some freelance work. What might be considered business expenses that I can deduct on my taxes? —Kaley A.

The writing business is like any other business, and that means you get the benefit of business-related tax breaks. If you’re a writer and are earning money from your writing (or are at least trying to earn money from it), you can deduct most materials related to your writing venture. This includes pens, paper, printing costs, postage and other writing supplies (though not snacks such as nacho-cheese-flavored Doritos, even if you get your cheesy fingerprints on the supplies—trust me, I’ve tried!).

Other deductible expenses that you should keep receipts for include writing-related travel costs, conference admissions, writing group or association fees, and business lunches—such as when you’re interviewing someone over lunch or dining with a potential client. Research materials (all those books, magazines and newspapers, huzzah!) are deductible, too. You may also deduct items such as a new computer or printer, though you may have to amortize the equipment deduction over a couple of years, so it’s best to consult with a professional tax preparer on those types of purchases.

Also, it’s important to note that if you claim your writing as a business, the IRS expects you to start making money after a couple of years. So if you’re making minimal money, for tax purposes you may only be able to claim your work as a hobby, which would allow you to deduct expenses only up to the amount of income you’ve made from writing.

The key to tallying tax deductions for writing-related business expenses is to keep receipts and records for everything. That way, if you’re ever audited, you’ll have the documentation to back it up.

But, if you’re ever in doubt, consult a professional tax preparer.

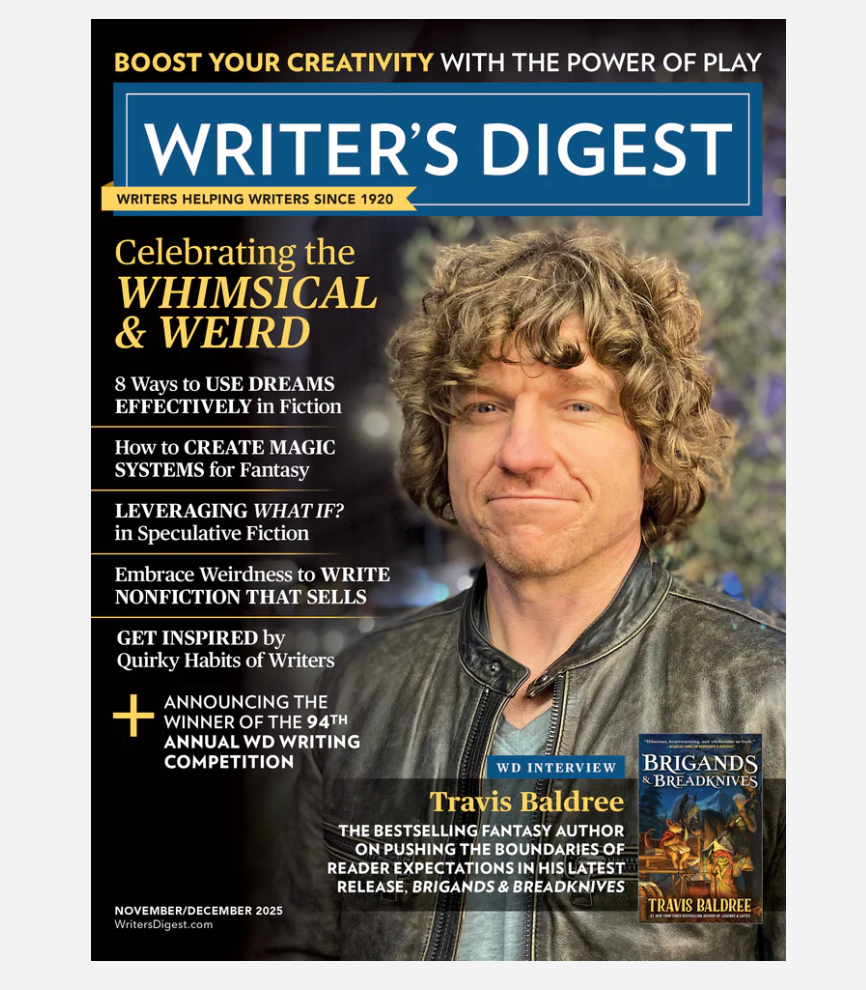

Want to learn more that can save you money?

Get Finances and Tax Issues for Writers.

For a few bucks you can improve the business side

of your writing career. Order now.

Finances and Tax Issues for Writers

**********************************************************************************************************

Follow Brian on Twitter: @BrianKlems

Sign up for Brian's free Writer's Digest eNewsletter: WD Newsletter

Buy Brian's book OH BOY, YOU'RE HAVING A GIRL, A DAD'S SURVIVAL GUIDE TO RAISING DAUGHTERS

Brian A. Klems is the former Senior Online Editor of Writer’s Digest, and author of Oh Boy, You’re Having a Girl (Adams Media/Simon & Schuster). Follow him on Twitter @BrianKlems.